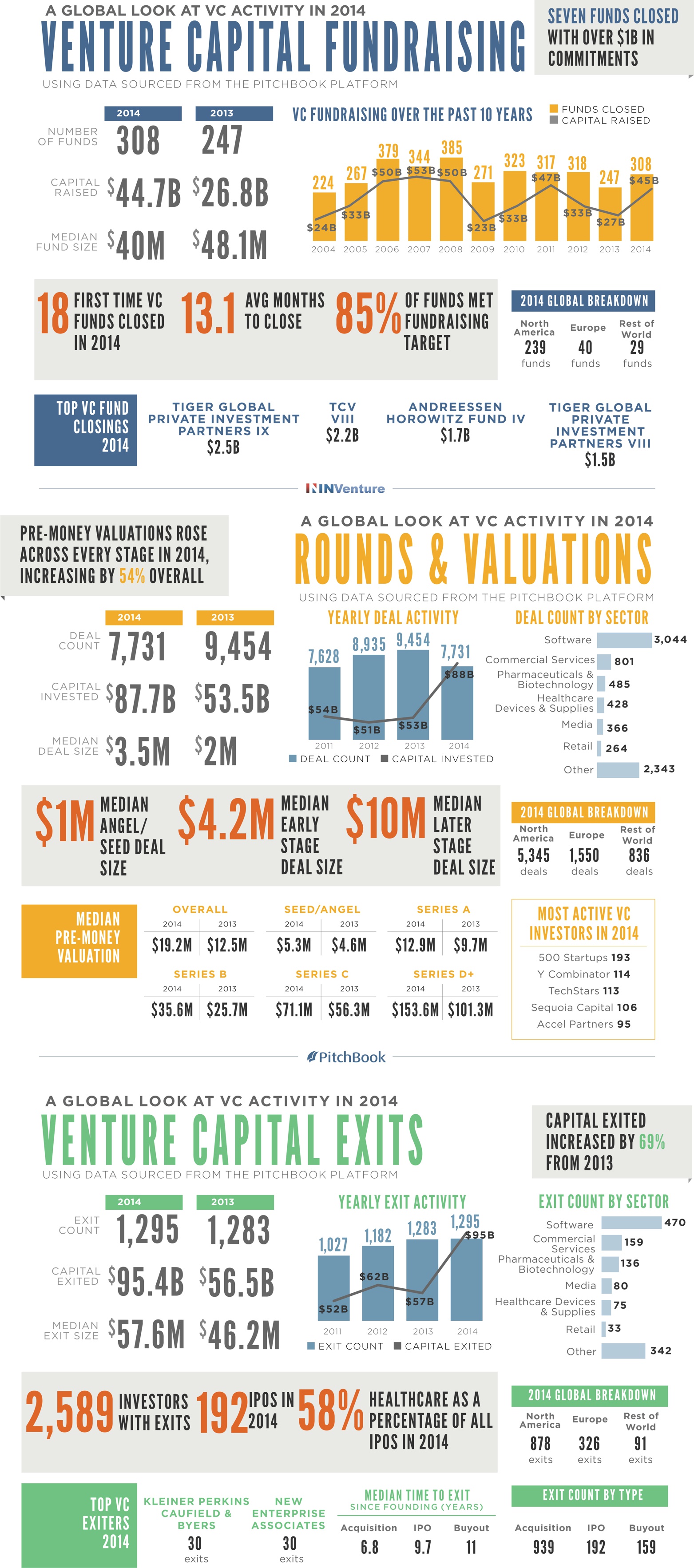

2014 was an exceptional year for the venture capital industry. With the growing number of unicorns and the incredible amount of capital flowing into startups and emerging markets, one cant help but draw comparisons to the dot-com era. In fact, total capital invested has reached levels not seen since the late nineties, reaching more than $88 billion this year; up from $54 billion in 2013 - nearly a 40% increase. Interestingly, this stark rise in capital invested is no indication of overall deal flow, as global deal count fell from 9,454 deals in 2013 to 7,731 this year, showing that investors are pouring more capital into fewer deals. Additional key highlights from the year can be found below.

Key Facts Sourced from the PitchBook Platform:

Global Venture Deals

- Deals by Region: North America accounted for 67% of total capital invested globally. Europe saw an uptick in VC financing, with $11.3 billion invested in 2014 - the highest in the last 10 years, and 13% of total global VC.

- Median Deal Size: Global median venture deal size nearly doubled in 2014, rising from $8 million in 2013 to $14.7 million in 2014. Below is a detailed breakdown by series,

- Seed: Global median Seed deal size increased 75% in the last year, rising from $2.4 million last year to $4.2 million in 2014

- Series A: Median Series A deal size increased 33% in the last year, rising from $14.7 million in 2013 to $19.5 million this year

- Series B: Global median Series B deal size increased 56% in the last year, rising from $30.4 million in 2013 to $47.5 million this year

- Series C: Median Series C deal size increased 29% in the last year, rising from $54 million to $69.9 million in 2014

- Series D: No surprise here, median Series D deal size increased 81% in the last year, rising from $66.6 million in 2013 to $120.3 million this year

- Largest deals: Uber stole the show by raising a total of $2.4 billion through its latest Series D and E rounds, followed by Xiaomi Technologies and Flipkart, which both raised $1 billion in 2014

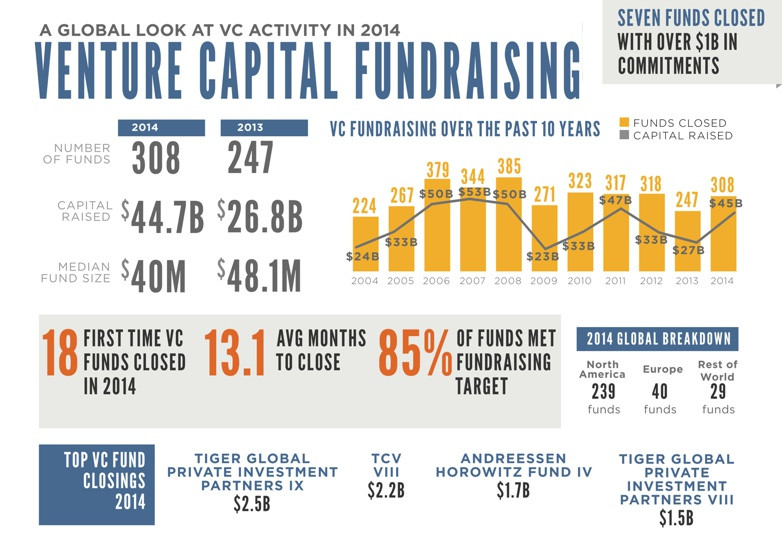

Global VC Firm Fundraising

- Total Closes: It was a strong year for VC fundraising, with 308 funds raised and $44.7 billion secured globally.

- Fundraising Success: 85% of 2014 funds hit their target, while 30% exceeded their targets.

- Fundraising by Region: 2014 proved to be a strong year of fundraising for North America, where 239 funds were closed and $32.58 billion was secured. Europe fundraising nearly matched that of 2013, with 40 funds closed both years.

- Largest Funds: Tiger Global Private Investment Partners IX was the largest VC fund raised in 2014, totaling $2.5 billion.

Global Venture Exits

- Total Exits: Global exit flow climbed in 2014 with 1,295 exits totaling $95.4 billion, up from 1,283 exits and $56.5 billion exited last year

- Exits by Region: North America accounted for nearly 83% of global capital exited in 2014. Europe realized 12% of total capital exited in 2014.

- Exits by Industry: Software industry exits continue to grow rapidly, accounting for roughly 36% of total capital exited globally. Additionally, exits in Pharma & Biotech increased 53% since last year, with 136 exits globally.

- Largest Exits: Far and away, WhatsApps $22 billion acquisition by Facebook was the largest exit of 2014. Other top exits include Nest Labs ($3.2 billion), Oculus VC ($2 billion) and JD.com ($1.8 billion)

Comment:

"This year, the global venture industry hit its stride, reaching numbers we havent seen in over a decade," reports John Gabbert, CEO and Founder of PitchBook Data, Inc. "And we expect 2015 to pick up right where it left off. Capital will remain readily available across the venture lifecycle and valuations will continue to rise. One of the big stories well be tracking in 2015 is the continued maturation and growth of venture activity outside of Silicon Valley."